will capital gains tax rate increase in 2021

The rate could be as high as 396 matching the top ordinary income tax rate before the Tax Cuts and Jobs Act TCJA. It would be very surprising to see the capital gains rate go higher than 28.

Nft Tax Guide What Creators And Investors Need To Know About Nft Taxes Taxbit Blog

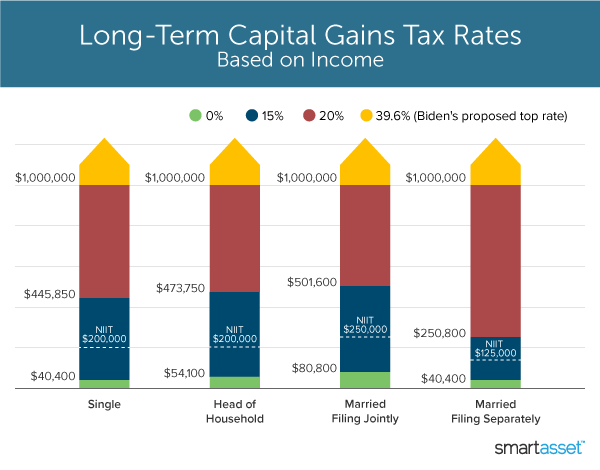

Among individual taxpayers in 2021 those making 40400 or less without paying capital gains tax wont have to pay capital gains tax in that case.

. On average individual taxpayers in 2021 wont have to pay capital gains tax if their taxable income is below 40400. Zad Siadatan talks about current capital gains tax and what might change during 2021. Aligning rates of CGT to income tax levels.

Gains from the sale of capital assets that you held for at least one year which are considered long-term capital gains are taxed at either a. How much these gains are taxed depends on how long the asset was held before selling a year or less than a year. What Is The Capital Gains Rate For 2021.

The proposal would increase the maximum stated capital gain rate from 20 to 25. In any case theyll pay 15 percent on capital gains if their income ranges from 40401 to 445850 per year. Reducing the annual gains allowance from 12300 to as little as 2000 per person but with fewer assets attracting the charge.

Unlike the long-term capital gains tax rate there is no 0 percent rate or 20. Married filing jointly. 7 rows 2021 federal capital gains tax rates.

It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. In areas above that income level rates increase by 20 percent. Therefore there could be an additional 8 tax on a transaction that closes in 2022 vs 2021.

In 2021 and 2022 the capital gains. Severely restricting Business Asset Disposal Relief which allows business owners selling up to pay a reduced rate of 10 per cent on the first 1m of gains. What Is The Capital Gains Rate For 2021.

House Democrats propose raising capital gains tax to 288 Published Mon Sep 13 2021 333 PM EDT Updated Mon Sep 13 2021 406 PM EDT Greg Iacurci GregIacurci. Capital Gains Tax Rate Update for 2021. Different types of realized capital gains are taxed by the CRA including securities some forms of real estate and other personal property that tends to increase in value over time.

Will Capital Gains Tax Increase. In fact recent intelligence suggests many Democrats favor a rate increase as low as 42 percentage points which would result in a 242 rate before net investment income NII tax and a 28 rate inclusive of the 38 NII tax. While it is unknown what the final legislation may contain the elimination of a rate increase on capital gains in the draft legislation is encouraging.

Being involved in the property industr. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. 15 Tax Rate.

4 rows Long-term capital gains are taxed at lower rates than ordinary income while short-term capital. Capital gains tax rates for 2021-22 and 2020-21. Its important to note that Biden is also proposing a tax hikethat will raise the top income tax bracket from 37 to 396.

This means that high-income single investors making over 523600 in tax year 2021 have to pay the top income tax bracket rate of 37. The IRS taxes short-term capital gains like ordinary income. President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends.

Additionally the proposal would impose a 3 surtax on modified adjusted gross income over 5000000 effective after December 31 2021. If you earn more than that the rate will rise to 20 percent. The Biden administration has proposed an increase in the current favorable capital gain rates for people earning more than 1 million.

Capital Gains Tax Rates for 2021. The tables below show marginal tax rates. In the case of income between 40401 and 445850 capital gains are taxed at 15 percent.

Based on filing status and taxable income long-term capital gains for tax year 2021 will be taxed at 0 15 and 20. What is the capital gains tax rate for 2021 UK. Short-term gains are taxed as ordinary income.

Since the inclusion rate for capital gains is 50 your taxable income would increase by 5000 in the 2021 tax year. The effective date for this increase would be September 13 2021. What Is The Us Capital Gains Tax Rate For 2021.

If you make a gain after selling a property youll pay 18 capital gains tax CGT as a basic-rate taxpayer or 28 if you pay a higher rate of taxGains from selling other assets are charged at 10 for basic-rate taxpayers and 20 for higher-rate taxpayers.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

Capital Gains Tax Rates 2021 And How To Minimize Them Union Bank

Made A Profit Selling Your Home Here S How To Avoid A Tax Bomb

The 2022 Capital Gains Tax Rate Thresholds Are Out What Rate Will You Pay

Double Taxation Definition Taxedu Tax Foundation

Us Crypto Tax Guide 2022 A Complete Guide To Us Cryptocurrency Taxes

Capital Gains Tax What Is It When Do You Pay It

Can Capital Gains Push Me Into A Higher Tax Bracket

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

What S In Biden S Capital Gains Tax Plan Smartasset

Capital Gains Definition 2021 Tax Rates And Examples

What S In Biden S Capital Gains Tax Plan Smartasset

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)